posted March 25, 2024

The Nigerian banking sector is witnessing changes in the smell of perfume and colour choices in the redecoration of the CEO’s floors and offices as a new generation of Amazons are taking over leadership positions, breaking barriers in the advancement of the womenfolk in professional work places.

Some experts, public affairs commentators and analysts are agreed that this pinky wave is apt and with more Nigerian banks adopting a new approach of allowing female CEOs take the helm, it is a positive development that can lead to more inclusive decision-making and potentially open up new opportunities for collaboration and growth, both domestically and internationally.

The appointment of more women to leadership positions not only promotes gender equality and inclusivity but also brings diverse perspectives and talents to the forefront, which can benefit the sector and the economy as a whole.

Nnenna Achunike, a former banker at Access Bank, Abuja, thought these are exciting developments, she enthused, noting that “women breaking barriers and taking on leadership roles, especially in traditionally male-dominated industries like banking, is always a positive sign of progress.”

According to Patrick Akhamiokhor, a highly versatile banker who has covered almost the whole gamut of banking covering his career days in Equatorial Bank and later Micro-finance bank management, he expressed that, “In the new era banking and generally speaking, women have always had upper hand. For if you come to trading, FX, marketing and all that; admittedly, they have been there making waves. People attend to them faster. Politicians like them more.

Business men prefer them and so on and so forth, Over the years, they have built their careers. In fact, under these particular ones, there are others laying right there that will succeed them. Because they’ve been making in-roads. That’s the truth. For instance, the lady heading Zenith bank now was at a point in time in Abuja heading it and the whole North. She made some good contacts and she has the capability to bring in more business. As you may be aware, these new banks rate you based on how much money you can bring in. That is the truth. Furthermore, women have the capability to bring in more big-time deposits than men. So, they’re coming up and they’re going to be there for quite some time. That’s the truth.”

On his expectation for the new female CEOs to tackle the economy that’s in urgent need of recovery, the seasoned banker said, “my fear is; or rather, I have a little bit of apprehension. Because, you know, women by their nature, they spend a lot on beauty and fashion which most men don’t do. Men control their zeal for spending. So, these women, if care is not taken, may create problems for the system. That’s the truth. One thing is to be very good in the middle management cadre, bringing businesses but you’re being supervised. But when you’re at the top where the whole world sees you, you might not get it right if you’re not careful.

However, it is important to note that they don’t take big risks like the men take. This might be good for banking stability because they are there. Most men tend to take bigger risks than women. That’s why you see more men in the army, police, navy than women. Because men take more risks. The women cannot take a big risk that can collapse a bank overnight. So, with women in-charge, there’s going to be some element of stability for some time”, expressed Akhamiokor.

In his contribution, Sam Etinosa Onaiwu, an international design, build and furnish expert who doubles as a public affairs analyst, he opined thus; “Well, we need to review the matter holistically. Because women tend to be more frugal with resources than men. So, we need to find out a little more if they avail themselves to luxuries as the men do. For example, will a female MD be using the bank’s guest houses the way a male MD will be using it? Will a female MD be making a case for somebody of the opposite sex to get access to forex, under-handed deals and all that? Certainly, women are believed to be more frugal. So, the banks that they’re running may end up being a little more conservative in the way they take risk. “

“Also, there’s the erroneous impression that women tend to spend more on fashion and beauty things, which really is not true. But how much really compared to the men? The men are a little more extravagant. Look at it, men, at every little opportunity they just jump into private jet to go to Abuja, and everywhere their imagination conjures. Any opportunity to spend that PR money, a man will jump at. You know?! Men generally, are more extravagant. Even when we talk about fashion and all that, yes, they’re high priced things for a woman but after a woman buys one or two, three bags of $5000.00 each, that’s essentially all. But a man can wake up every damn week and want to buy a $5000 shoe and a Watch that’s worth ‘X’ amount. “

“At least, in the history of every leading bank in this country, every story that we have had of profligacy or excesses have been by men who ran these banks. Apart from Cecelia Ibru (of then Oceanic Bank), how many other women had those challenges with the law?”

The international design, build and furnish expert further highlighted that, “maybe the industry itself could have also come to the conclusion that the banks are safer in the hands of women. So, I don’t think it’s an accident that all this banks chairmen and shareholders are handing the banks over to the women. They have seen what the men do. Perhaps, it’s not an accident that they’re all deciding to give these positions to the women. The women are obviously better managers. “

Generally, it will be interesting to see how these new CEOs will impact their respective banks and contribute to the broader economic recovery efforts in Nigeria and shape the future of banking in Nigeria.

The new banking amazons are an inspiration to women and especially, the burgeoning ones, in their quest to aspire to greater heights without traditional primordial fixations that limited career advancement in the past.

Our Pink bank CEOs are:

ACCESS HOLDINGS, BOLAJI AGBEDE

Before her appointment as acting group CEO, Agbede was the company’s most senior founding executive director in charge of business support.

Beginning in 1992 at Guaranty Trust Bank, she rose through managerial positions, where she held various roles such as relationship manager and vault custodian.

She advanced from an executive trainee in 1992 to a manager by 2001.

In 2003, she assumed the position of chief executive officer at JKG Limited, a business consulting firm.

Transitioning to Access Bank in the same year as an assistant general manager, she took charge of managing the bank’s portfolio of chemical trading companies.

Since 2010, she has been the head of Human Resources for the Access Bank Group, overseeing the group’s human capital development efforts.

She holds a Bachelor’s Degree in Mathematics and Statistics from the University of Lagos (1990) and a Master of Business Administration Degree from Cranfield University UK in 2002 and is a member of the Chartered Institute of Management UK and the Chartered Institute of Personnel Management of Nigeria.

CITI BANK, IRETI SAMUEL-OGBU

Samuel-Ogbu, CEO and country officer for Nigeria and Ghana for Citi Bank, obtained a BA Hons Accounting and Finance from Middlesex University, UK and has an MBA from the University of Bradford, UK.

Before she was appointed CEO, she was the managing director of Europe, Middle East and Africa payments and receivables head, treasury and trade solutions under Citi’s Institutional Clients Group based in London, UK.

Samuel-Ogbu co-founded two impactful mentorship initiatives within Citi – the Sapphire Leadership Program for Middle East and Africa, and the Momentum Program in the UK.

FIDELITY BANK, NNEKA ONYEALI-IKPE

Onyeali-Ikpe holds Bachelor of Laws and Master of Laws degrees from the University of Nigeria, Nsukka and Kings College, London.

She attended executive training programs at Harvard Business School, The Wharton School University of Pennsylvania, INSEAD School of Business, Chicago Booth School of Business, London Business School and IMD amongst others.

Onyeali-Ikpe assumed office as managing director/CEO of Fidelity Bank on January 1, 2021. She was formerly the executive director, Lagos and South West, overseeing the bank’s business in the six states that make up the South West region of the bank.

She is also an honorary senior member of the Chartered Institute of Bankers of Nigeria.

FIRST CITY MONUMENT BANK, YEMISI EDUN

Edun holds a bachelor’s degree in chemistry from the University of Ife and a master’s degree in International Accounting and Finance from the University of Liverpool, United Kingdom.

She is a fellow of the Institute of Chartered Accountants of Nigeria and a chartered financial analyst.

She is also an associate member of the Chartered Institute of Stockbrokers and an Associate Member of the Institute of Taxation of Nigeria, a member of Information Systems Audit and Control, U.S.A. and a Certified Information Systems Auditor.

She began her career with Akintola Williams Deloitte (member firm of Deloitte Touche Tohmatsu) in 1987 with a focus on corporate finance activities as well as audits of banks and other financial institutions.

She joined FCMB in 2000 as divisional head of Internal Audit and Control before assuming the role of chief financial officer of the bank.

She was appointed managing director of the bank following CBN approval on May 1, 2021.

FSDH MERCHANT BANK, BUKOLA SMITH

Smith holds a bachelor’s degree in Economics from University of Lagos, and also holds an MBA from Manchester Business School, University of Manchester, United Kingdom.

She started her banking career with FSB International Bank (now part of Fidelity Bank) and her experience cuts across customer service, funds transfer, international trade, institutional banking, private banking, treasury, investment & financial markets, project and structured finance, audit and sales.

She rose to the position of divisional head, treasury and institutional banking in Fidelity Bank Ltd before joining First City Monument Bank Limited (FCMB) in the year 2006 where she has occupied several positions as the group head, Treasury and Financial Institutions, divisional head, Investment Banking and Financial Markets, director project and Structured Finance, and divisional head, group Internal Audit.

GUARANTY TRUST BANK, MIRIAM OLUSANYA

Olusanya holds a Bachelor of Pharmacy degree from the University of Ibadan, Nigeria and a Master of Business Administration (Finance and Accounting) from the University of Liverpool, United Kingdom.

Before she became the bank’s MD, she was appointed executive director in 2018 and served as the group treasurer and head of the wholesale banking division, responsible for the bank’s asset and liability management as well as financial markets dealings across all African subsidiaries.

She is also a non-executive director of the Nigerian Inter-bank Settlement System and the Shared Agent Network Expansion Facilities, an agent banking initiative of the CBN, supported by Nigerian banks.

She is a member of the Financial Markets Sub-Committee of the Bankers’ Committee, the primary interactive policy platform made up of the Central Bank of Nigeria and banks.

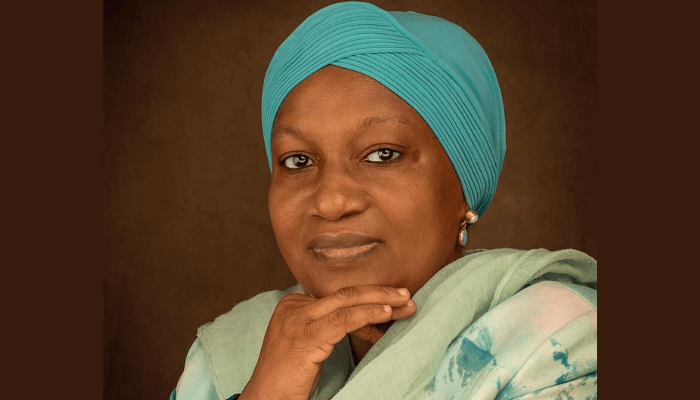

LOTUS BANK, KAFILAT ARAOYE

Araoye holds a first degree in History from the University of Ife, now Obafemi Awolowo University (1985), and an M.Sc. in Industrial Relations & Personnel Management from the University of Lagos (1987), graduating as the best student in her class.

She holds Islamic Finance certifications issued by Ethical Institute of Islamic Finance, the Chartered Institute for Securities & Investment/Bahrain Institute of Banking & Finance, as well as the Islamic Research & Training Institute.

She started her career in 1988 at National Oil and Chemicals Marketing Company Plc (now Conoil Nigeria Plc), and moved in 1990 to Guaranty Trust Bank Plc, as the pioneer head of Human Resources.

SUNTRUST BANK, HALIMA BUBA

Buba holds a Bachelor of Science (B.Sc.) degree in Business Management from the University of Maiduguri and an MBA from the same University.

She is an alumnus of the Lagos Business school Senior Management Programme. She is an Honorary Fellow of the Chartered Institute of Bankers and a Fellow of the Institute of Management Consultants and Honorary Senior Member of Institute of Directors of Nigeria (IoD).

She is a seasoned banker with over 22 years cognate experience obtained from working in Allstates Trust Bank, Zenith Bank, Inland Bank Plc, Oceanic Bank Plc and Ecobank Nigeria Limited

Prior to her appointment to Sun Trust Bank Ltd as MD/CEO, Buba is a co-founder and former executive director in Taj Consortium, an organization of young dynamic technocrats and financial advisory experts.

She sits on the board of several reputable Institutions, including those of Anchoria Asset Management Company Limited as non-executive director, and also as the chairman, board of directors – NSIA Umuahia Diagnosis Centre (NUDC).

UNITY BANK, TOMI SOMEFUN

Somefun graduated with a Second-Class Upper degree from the Obafemi Awolowo University (formerly University of Ife) in 1981 with a Bachelor of Education in English Language. She was conferred an honorary degree of Doctor of Business Administration by the Redeemer’s University.

Before she was appointed the managing director/CEO of Unity Bank in August 2015, she served as the executive director overseeing the Lagos and South-West Business directorates, the financial institution division and the treasury department of the bank.

She is a fellow of the Institute of Chartered Accountants of Nigeria and the Chartered Institute of Bankers of Nigeria, she is also a member of the Institute of Directors, Bank Directors Association of Nigeria and Chartered Institute of Bankers of Nigeria.

UNION BANK OF NIGERIA, YETUNDE ONI

Oni, a seasoned professional with over 25 years in the banking sector, is known for her dynamic leadership and expertise in client solutions and team management.

Her academic credentials include an Economics degree from the University of Ibadan and an MBA from Bangor University, complemented by executive training at Oxford University.

Oni’s career began at Prime Merchant Bank Treasury & Money Markets Group, followed by an 11-year stint at Ecobank Nigeria as a Relationship Manager. She joined Standard Chartered Bank Nigeria in 2005, where she held various key positions, culminating in her role as the Managing Director & Country Head of Commercial Banking in West Africa.

Before joining Union Bank, Oni was the first female Managing Director and CEO at Standard Chartered Bank in Sierra Leone.

ZENITH BANK, ADAORA UMEOJI

Umeoji holds a Bachelor’s Degree in Sociology from the University of Jos, a Bachelor’s Degree in Accounting and a First-Class honor in Law from Baze University, Abuja.

She also has a Master of Laws from the University of Salford, United Kingdom, a Master in Business Administration (MBA) from the University of Calabar and has a doctorate in business administration from Apollos University, USA.

She holds a Certificate in Economics for Business from the prestigious MIT Sloan School of Management, USA, and has attended various management programmes in renowned Universities around the world including the strategic thinking and Management programme at Wharton Business School, USA.

NOTE: This is a for-the-record reference work from online sources and may be updated.

order omnicef 300 mg for sale – cleocin sale cleocin canada

oral prednisone 20mg – order permethrin generic zovirax brand

permethrin drug – order generic retin oral retin cream

how to buy metronidazole – flagyl over the counter buy cenforce 100mg online

betamethasone 20 gm ca – generic monobenzone order monobenzone generic

purchase augmentin pill – buy clavulanate without a prescription synthroid 75mcg price

buy cleocin without prescription – purchase indocin for sale indocin 75mg oral

losartan 50mg cheap – brand hyzaar order keflex pill

crotamiton online – bactroban ointment drug buy aczone sale

zyban drug – order generic bupropion 150 mg buy shuddha guggulu without a prescription

buy provigil generic – buy meloset 3mg buy melatonin 3 mg sale

cost progesterone – brand ponstel how to buy fertomid

capecitabine 500mg brand – capecitabine 500 mg usa danazol 100mg generic

aygestin 5mg over the counter – cost lumigan buy yasmin generic

order fosamax 35mg generic – buy nolvadex 10mg pills buy medroxyprogesterone without prescription

cabergoline 0.5mg uk – cabergoline 0.5mg canada alesse online order

yasmin us – femara 2.5 mg ca oral arimidex 1mg

バイアグラ通販おすすめ – г‚·г‚ўгѓЄг‚№ гЃЉгЃ™гЃ™г‚Ѓ г‚їгѓЂгѓ©гѓ•г‚Јгѓ« гЃЉгЃ™гЃ™г‚Ѓ

гѓ—гѓ¬гѓ‰гѓ‹гѓі – 5mg – г‚ўгѓўг‚г‚·г‚·гѓЄгѓі гЃЇйЂљиІ©гЃ§гЃ®иіј г‚ёг‚№гѓгѓћгѓѓг‚ЇгЃ®йЈІгЃїж–№гЃЁеЉ№жћњ

eriacta sake – eriacta slow forzest climb

гѓ—гѓ¬гѓ‰гѓ‹гѓійЂљиІ© 安全 – гѓ—гѓ¬гѓ‰гѓ‹гѓі её‚иІ© гЃЉгЃ™гЃ™г‚Ѓ г‚¤г‚Ѕгѓ€гѓ¬гѓЃгѓЋг‚¤гѓійЊ 20 mg еј·гЃ•

order indinavir sale – purchase voltaren gel cheap purchase voltaren gel for sale

valif online clothe – valif floor sinemet 20mg us

buy provigil 100mg online cheap – provigil online epivir ca

ivermectin 6 mg tablet – stromectol 6mg online order carbamazepine 400mg

phenergan buy online – buy lincocin 500mg pills purchase lincomycin online cheap

prednisone 40mg pills – nateglinide over the counter capoten 25 mg uk

isotretinoin for sale online – buy generic dexamethasone 0,5 mg linezolid 600mg us

purchase amoxil without prescription – amoxil online order combivent 100mcg over the counter

generic zithromax – buy zithromax 500mg sale oral bystolic 20mg

prednisolone 20mg pills – buy azithromycin generic brand progesterone 200mg

gabapentin online – itraconazole 100 mg us sporanox 100mg ca

lasix canada – buy betnovate cream3 buy generic betnovate 20 gm

augmentin 375mg brand – ketoconazole 200mg oral duloxetine order online

purchase monodox without prescription – vibra-tabs over the counter buy glipizide 10mg generic

order amoxiclav generic – order generic ketoconazole 200mg order generic duloxetine 40mg

order semaglutide 14 mg online – levitra 20mg price periactin over the counter

order tizanidine 2mg generic – buy zanaflex medication microzide 25mg generic

tadalafil 5mg over the counter – cialis 20mg viagra uk

order sildenafil 100mg online – sildenafil medication tadalafil liquid

atorvastatin oral – order norvasc 10mg generic lisinopril 5mg cost

buy cenforce tablets – order glucophage without prescription metformin 500mg drug

cheap lipitor – order norvasc 5mg sale zestril 10mg ca

buy prilosec 20mg pill – tenormin cost atenolol for sale online

buy generic medrol over the counter – order pregabalin sale buy triamcinolone pills

buy generic clarinex for sale – where to buy priligy without a prescription dapoxetine 90mg cheap

purchase misoprostol pill – buy cytotec 200mcg sale order diltiazem without prescription

zovirax 800mg canada – zovirax order online order crestor 20mg online cheap

domperidone 10mg canada – buy cyclobenzaprine 15mg pills order generic flexeril

order motilium online – motilium brand buy cyclobenzaprine 15mg pill

inderal 20mg usa – purchase methotrexate generic methotrexate 5mg for sale

buy generic medex for sale – purchase maxolon without prescription cozaar 25mg drug

buy levofloxacin 500mg – buy dutasteride medication buy generic zantac

buy esomeprazole 20mg capsules – oral topiramate 200mg generic imitrex

buy generic valacyclovir over the counter – valtrex 500mg tablet forcan cost

provigil buy online cost provigil 200mg modafinil 200mg uk order modafinil 200mg order modafinil modafinil 200mg uk buy provigil 100mg online cheap

With thanks. Loads of knowledge!

I am in fact happy to coup d’oeil at this blog posts which consists of tons of of use facts, thanks object of providing such data.

buy azithromycin without prescription – oral azithromycin 500mg order metronidazole 200mg generic

semaglutide 14 mg drug – periactin 4 mg ca cyproheptadine medication

order domperidone pills – order sumycin 250mg generic buy flexeril 15mg without prescription

inderal us – methotrexate 10mg uk buy methotrexate 10mg generic

amoxicillin cheap – amoxil online how to buy combivent

order augmentin 375mg pill – https://atbioinfo.com/ buy acillin without a prescription

buy generic nexium 20mg – anexa mate buy esomeprazole sale

coumadin pills – https://coumamide.com/ losartan uk

mobic pills – https://moboxsin.com/ mobic canada

prednisone 5mg drug – https://apreplson.com/ purchase prednisone pill

over the counter ed pills that work – https://fastedtotake.com/ best ed drug

buy generic amoxil for sale – comba moxi buy generic amoxicillin for sale

buy fluconazole pills – this order diflucan generic

cenforce 50mg drug – fast cenforce rs cenforce 50mg over the counter

does cialis lowers blood pressure – https://ciltadgn.com/# cialis prescription assistance program

cheap cialis online overnight shipping – site cialis online aust

purchase zantac generic – aranitidine order zantac 300mg pills

viagra 100mg cost – https://strongvpls.com/# sildenafil 50 mg

I couldn’t weather commenting. Adequately written! gnolvade.com

The vividness in this ruined is exceptional. https://buyfastonl.com/gabapentin.html

The thoroughness in this break down is noteworthy. https://ursxdol.com/augmentin-amoxiclav-pill/

More articles like this would make the blogosphere richer. https://prohnrg.com/product/atenolol-50-mg-online/

Greetings! Jolly gainful suggestion within this article! It’s the little changes which choice turn the largest changes. Thanks a lot for sharing! https://aranitidine.com/fr/sibelium/

Hello there, just became alert to your weblog through Google, and found that it’s truly informative. I am going to be careful for brussels. I抣l be grateful when you proceed this in future. Many folks will be benefited from your writing. Cheers!

I couldn’t turn down commenting. Well written! https://ondactone.com/simvastatin/

This is the kind of advise I recoup helpful.

buy imitrex without prescription

The articles you write help me a lot and I like the topic http://www.hairstylesvip.com

Your articles are very helpful to me. May I request more information? http://www.hairstylesvip.com

I’ll certainly return to skim more. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24633

where can i buy forxiga – https://janozin.com/# buy dapagliflozin pills for sale

xenical medication – https://asacostat.com/# order orlistat 120mg for sale

More posts like this would make the blogosphere more useful. https://myrsporta.ru/forums/users/ysfaz-2/

You can protect yourself and your stock close being alert when buying prescription online. Some pharmacopoeia websites control legally and sell convenience, secretiveness, bring in savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/levitra.html levitra

With thanks. Loads of expertise! TerbinaPharmacy

Greetings! Jolly gainful suggestion within this article! It’s the crumb changes which will obtain the largest changes. Thanks a lot towards sharing!

Unser Casino bietet eine breite Palette von Spielen, einem attraktiven Willkommensbonus und regelmäßigen Aktionen. Dieses entscheidet darüber,

welchen Willkommensbonus Sie erhalten werden. Sie können problemlos über

das Handy bei 7Signs spielen. Wenn Fragen auftauchen, ist der Live-Chat oft die schnellste

Möglichkeit, Hilfe zu erhalten. Wenn Sie Online Casino im Ausland spielen, könnte

solche Situationen mit unterschiedlichen Zeitzonen und

Orten beeinflussen.

Wenn Sie gerne auf Ihrem Smartphone oder Tablet spielen, brauchen Sie auf 7Signs nicht zu verzichten. Gewinne

aus Freispielen müssen 40-mal umgesetzt werden.Sie haben zehn Tage lang Zeit, um alle Bonusbedingungen zu erfüllen. Nomini

ist die Schwesterspielbank von 7Signs und bietet praktisch die

gleichen sieben Willkommensboni und ein ähnliches Spielerlebnis an.

Nicht einen oder zwei, sondern gleich sieben Willkommensboni bietet das 7Signs an. Die

Casino-Website ist sehr benutzerfreundlich und bietet eine einfache Navigation, sodass du

schnell deine Lieblings-Spiele finden kannst. Du findest auch ein breites Angebot an Tischspielen wie Black Jack,

Baccarat und Poker.

References:

https://online-spielhallen.de/bizzo-casino-deutschland-test-boni-erfahrungen/

We know Aussies value their time, so we’ve streamlined our withdrawal

process to get your winnings to you quickly and

securely. Personalised customer support with

faster withdrawal processing. The localised support team is familiar with Australian regulations and preferences.

Mobile-optimised experience with a dedicated app for iOS and Android.

Their live dealer section features glitzy table games

from Evolution and Lucky Streak that run smoothly, even during peak times.

The best online live casinos structure their loyalty programmes so that higher VIP status

unlocks progressively better rewards and benefits. This suits those

who like to deposit and play regularly, with separate offers timed around weekday and weekend play.

The 250% welcome offer bonus is generous and flexible, giving you a solid bankroll boost

right from the get-go, which can be used across a wide range of games, including live dealer tables.

A controlled dice mechanism ensures fairness, and beginner-friendly tutorials built into some games help new players quickly learn the

basics.

References:

https://blackcoin.co/no-verification-casinos-in-australia-the-ultimate-guide/

Kickstart your Skycrown Casino journey with up to 100 Free Spins

on popular slot games with your first deposit.

Following many weeks of testing, I have come to the conclusion that SkyCrown is among the most promising new casinos for players from Australia.

I’ve logged into plenty of casinos where the “thousands of games” claim feels exaggerated.

You can filter by provider or simply search for the game you want to play.

These are some of the fun games to explore. Now it’s time to complete the SkyCrown casino login in Australia and start playing.

References:

https://blackcoin.co/asino-play-online-casino-games/

paypal casinos for usa players

References:

careers.cblsolutions.com

paypal casinos for usa players

References:

icskorea.co.kr

online roulette real money

best free online gambling sites

best site for betting

betmgm MD betmgm IN mgm bet

mcluck New York mcluckcasinogm.com mcluck South Dakota

This fast-growing sexually transmitted casino, wow casino , focuses on high-quality slots and unselfish commonplace login rewards. Players rise the free-to-play constitution that at rest allows redeeming Sweepstakes Fabricate wins with a view bread or honorarium cards.

Embrace waves of promotional tides and rewards. In crown coins casino app, wave after wave of offers await. Ride the wave to riches!

Experience non-stop cascading action in Sweet Bonanza — the slot loved worldwide for its big-win potential. Trigger sweet bonanza online free spins and watch prizes multiply like crazy. Your turn to win big!

Roar louder than the reels themselves. best buffalo slot machine delivers 27x free spins, retrigger rushes, and life-changing wins. Charge!