By Chinedu Onuoha / July 22, 2024

The first half of 2024 has been a remarkable period in the Nigerian payment ecosystem, marked by a noticeable moderation in the growth of point-of-sale (POS) transactions and an increase in the volume of fraud incidents. However, unlike POS transactions, the number and value of interbank transactions have maintained an upward tick indicating a healthy growth in account-based payments. The stagnation of POS transactions, it is believed, signals a critical juncture that urges industry stakeholders to step back and reassess the policies and strategies that have brought it to this point.

The exit of Mr. Chibuzo Efobi from the Payments System Management Department (PSMD) of the Central Bank of Nigeria (CBN) in May this year came as a shock to the industry. While we await the appointment of a new director, it is encouraging to see the department taking proactive measures to rectify some of the unintended anomalies that have accumulated over the years from the numerous policies and guidelines of the CBN. It is imperative that these correction efforts are not derailed, and that a clear, strategic direction is established starting with the appointment of a new leadership.

The licensing of a second Payment Terminal Service Aggregator (PTSA) in April, marks a deviation from the single hub and spoke architecture of the electronic payment ecosystem which was built around NIBSS as the national central switch. With Unified Payments as the second PTSA, we expect a significant derisking of the payment infrastructure and increased efficiency in the deployment of new payment innovations.

As we take a peep into the performance of some digital payment indicators in the first half of 2024, we are reminded of the uninspiring direction that the CBN’s cash-lite aspiration has crawled into in recent years. Cash payments have continued to grow outside the banking system as Nigerians have evolved a unique but inefficient way to build cash payments into the last mile of electronic transactions with the spread of POS agents. Between January and March this year, currency outside the Banking system rose from 90% in January to about 94% as at the end of Q1 – a poor report card on Nigerian payment digitalization efforts.

Declining POS transactions and increasing fraud cases

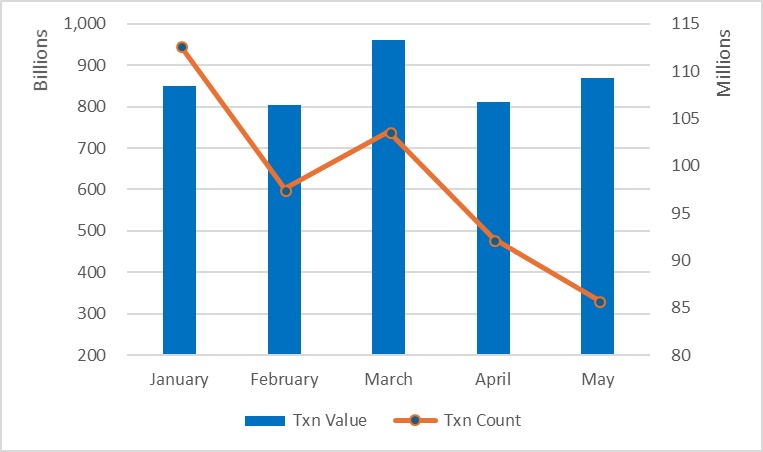

There was noticeable decline in the volume of POS transactions processed through the Nigerian Interbank System Services (NIBSS) platform in the first 5 months of 2024- from over 110 million transactions in January down to about 85 million transactions in May. Despite this decline, the value of monthly POS spends by consumers remained stable at about 800 billion naira per month. Some have suggested that the decline in transaction volume is an indicator of the decline in purchasing power of Nigerian consumers. Another school links the stagnation to the ban issued to Opay and other fintechs which prevented them from opening new accounts. What is not in doubt, however, is that there is an urgent need to reassess the entire ecosystem with the objective to attracting new users and improving the confidence of existing ones.

Source: NIBSS Monthy Transaction Report

Until April this year, POS operations in Nigeria had been based on a hub and spoke architecture where every POS device in the country was expected to be connected to a single aggregation point at NIBSS. The implication of this arrangement was that once there was a failure at NIBSS, the entire country witnessed a downtime in POS transactions. There were exceptions though, as some Fintechs by-passed NIBSS to have a direct connection to some banks. Although this arrangement ensured greater transaction success rate on such terminals, it ran against the CBN guidelines for POS transaction processing.

It is on this basis that the licensing of Unified Payments as the second PTSA comes as a very welcome development. However, it also brings to the fore the need to harmonise dispute resolution system for POS transactions. In the first 5 months of 2024, there were over 70 million decline transactions. Some of these transactions would lead to outright losses to customers as they become lost in the dispute resolution loopholes. Another area where collaboration of the two PTSAs must focus on is in the spiraling incidents of POS frauds. According to Financial Institutions Training Center (FITC), the number of reported incidents of POS fraud rose by 31% in Q1 2024.

Interbank transfers maintain a healthy growth

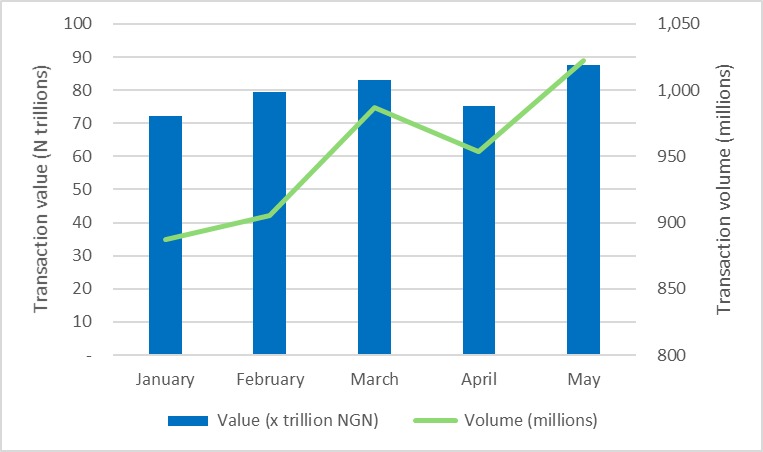

While there are other interbank transaction processing platforms in Nigeria, the Nigeria Interbank Payment (NIP) platform has emerged as the platform of choice among banks and their customers as it guarantees instant transaction value to beneficiary with over 99% success rate. It also has about the largest network of active financial institutions guaranteeing payments into about 40 financial institutions. It is not surprising that the number of transactions on this platform recorded an uptick during the period from about 900 million transactions in January to over a billion transactions in May, representing over a 10% growth.

Source: NIBSS Monthy Transaction Report

The Potentials of Mobile Payment still remain untapped

Mobile payments in Nigeria have shown remarkable growth over the years, driven primarily by the increasing adoption of smartphone-based applications. These apps have enabled a wide array of financial transactions, from transfers and bill payments to online shopping, offering convenience and efficiency to users. However, this growth is largely limited to the segment of the population that can afford smartphones and the associated data costs. Consequently, the broader potential of mobile payments remains untapped, particularly among those who do not have access to these devices.

USSD-based payments, which do not require internet access and are compatible with basic mobile phones, once held the promise of bridging this gap. Over the last decade, USSD payments saw rapid growth, offering a viable alternative to app-based transactions for millions of Nigerians. Unfortunately, the ongoing disputes between banks and telecommunications companies over revenue sharing and service rights have severely hampered the progress of this payment method. As a result, the promotion and development of USSD payments have stagnated, leaving a significant portion of the population underserved.

The fallout from these industry disputes is evident in the increasing reliance on cash transactions and POS agents. With banks no longer vigorously promoting USSD services, many customers have reverted to cash-based transactions, exacerbating the challenges of achieving a cashless economy. The promise of mobile payments as a tool for financial inclusion is thus undermined by these systemic issues, leaving a critical gap in the Nigerian payment ecosystem.

Subscribe To The Best Team In Conservative, Business, Technology, Lifestyle And Digital News Realtime! support@ddnewsonline.com

Agency Banking or POS?

According to Shared Agent Network Expansion Facilities Limited (SANEF), an entity setup by the CBN in conjunction with the banks to promote financial access point proliferation in Nigeria, there are about 1.8 million financial service agents across the country. These access points have settled into the role of now popular POS Agents focusing on cash dispensing as their primary financial service.

The profitability of their cash dispensing service has come with many unintended consequences including driving cash away from bank vaults. They have also increased the cost of payment transactions as POS agents collude with merchants in the local markets to truncate what otherwise would have been seamless electronic transactions between consumers and merchants. Some merchants who insist on collecting cash, advise their customers to withdraw cash from POS Agents. These merchants in turn sell back their cash to POS Agents at the end of the day.

The seemingly uncontrolled growth in POS Agents in the last two to three years has meant that not enough due diligence is observed in selecting and qualifying candidates for POS Agents. The result is that criminals have permeated the space, leveraging the trusted service to dupe and steal from unsuspecting users. It is on this note that the requirement by CAC demanding the registration of these agents comes as a welcome development. Beyond this, financial institutions cannot abdicate their due diligence roles and Know Your Customer (KYC) obligations while pushing their terminals into the hands of agents.

Above all, the industry needs to realign the role of these agents to the original goals of serving as representatives of financial institutions and not just as cash merchants. An agent should be empowered to provide account opening services, user education, product on-boarding, and dispute resolution. That is the real progress needed in this space. It is not too late to turn the corner.

Will ATMs Find Resurrection?

At the beginning of the last decade, banks engaged in fierce competition over the number of ATMs they could deploy, with elaborate ATM galleries serving as a point of pride. However, in recent years, the number of functional ATMs has continued to decline as banks no longer find it attractive to invest in ATM infrastructure. In Nigeria, the cost of running automated teller machines (ATMs) is prohibitively high, making their deployment outside bank premises nearly unfeasible. Banks face numerous challenges, including the provision of stable power, the cost and logistics of cash supplies, the security of the ATMs, and the poor quality of notes that frequently cause the machines to jam. Additionally, the cost of manpower needed to maintain these machines is substantial, as ATMs often require constant attention to resolve cash jams and other technical issues.

This situation was worsened by the regulatory pricing regime introduced by the CBN which favoured banks that did not invest in expensive ATM infrastructure. Imagine a situation when the cost to a bank of dispensing cash from its own ATM is over N100 per transaction, but the CBN allows customers to withdraw cash from other banks’ ATMs for a paltry N35 per transaction, the financial incentive to maintain a large ATM network diminishes significantly. This reality has led banks to reduce their investments in ATM infrastructure, choosing instead to minimize their operational costs.

Today, very few banks are willing to maintain their ATMs, and even those that do so often limit the amount of cash that can be withdrawn by customers, making the service unattractive. As a result, many customers have turned away from ATMs, preferring to pay higher fees to local POS agents rather than face the frustration of unreliable ATMs. This decline in ATM availability and reliability further highlights the need for the CBN and industry stakeholders to rethink the Nigerian payment system.

Time to review the fundamentals

As we navigate into the second half of 2024, the call to reassess the strategic direction of the Nigerian payment system becomes louder than ever. It is imperative for regulators and industry players to refocus on efficiency and access goals by enabling functional and effective end-to-end digital payments, especially in the lower segments of society. Low-cost and accessible mobile payments hold the key to achieving these objectives and should not be abandoned.

With tens of millions of cards in the hands of Nigerian customers, it is crucial to bring POS purchase transactions back onto the path of growth. Minimising incidents of fraud, reducing transaction failure rate, and improving the dispute resolution process should be pursued with vigour. The industry also needs to reposition POS agents as partners in promoting transaction efficiency and financial access. Cash vending is antithetical to the objectives of digital payments and should be minimised.

Chinedu Onuoha is a digital payments expert and ex-Chairman, Association of Licensed Mobile Payment Operators (ALMPO).

Note: Opinions expressed by Columnists/Contributors is theirs and do NOT necessarily reflect the views of DDNewsonline.com