posted July 09, 2024

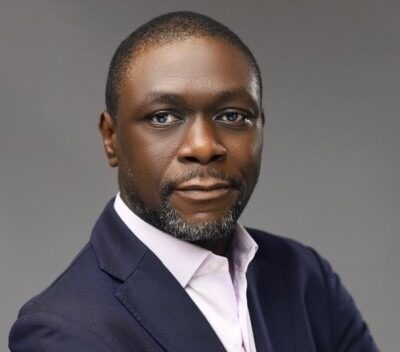

A leading Fintech Solutions Consultant and Principal Consultant at Labrys Consults, Mr. Kayode Ayo, has emphasized that the future success of the banking and financial sector hinges on embracing Fintech supports solutions.

In an interactive session with the media in Lagos on Tuesday, Ayo highlighted the necessity for banks to integrate people-to-people marketing tools and professionals to boost their operations and remain competitive in the digital marketplace.

Ayo pointed out the global shift in banking practices, noting that traditional policy structures are being upended by technological advancements. “Banks and financial institutions lack the manpower and resources to manage all aspects of traditional banking operations. Therefore, they must outsource certain basic functions to specialized vendors,” he explained.

He underscored the rapid pace of technological growth and its impact on business and human engagements, stressing the need for banks to adopt proactive measures to engage both new and old customers.

“What this means is that Nigerian banks cannot be left behind the global trend. So, for them to stay ahead of competition and meet market expectations, they must deploy innovative Fintech solutions,” Ayo concluded.

According to Kayode Ayo, there is the increasing imperative to develop or outsource solution vendors, in order to improve their acquisition by accessing merchants or direct sales resource platforms that can impact their operations positively.

The imperative for the banks is to enter support relationship with Fintech solution vendors to help them engage their clientele base and deliver basic information or services to them through acquisition and onboarding merchants and aggregators.

“This is what will provide a leeway for the vigorous marketing of their products and services with less arithmetic costs. This the precursor to achieving more operational fortunes”, said the expert.

Kayode Ayo is a Project Management Professional (PMP®), Certified Manager of Quality and Organizational Excellence (CMQ/OE®), and Process Improvement Specialist with several years of diverse work experience, comprising of roles in the oil and gas, financial services, telecommunications, and information technology sectors.

During a professional career spanning over two decades, he has led and championed process improvement initiatives, established and monitored customer-supplier relationships, utilized knowledge management tools and techniques in identifying and managing projects and processes in several world class organizations such as Shell Petroleum Development Company (SPDC), Oceanic Bank Plc., MTN Nigeria Communications Ltd, Etisalat Nigeria (9 Mobile), Blueprint Business Technologies and Spout Payment Solutions (SpoutPay).

Kayode Ayo, who is a regular Project and Quality Management Facilitator at the Pan African University (Lagos Business School), currently doubles as the Principal Consultant at Labrys Consults, a consulting firm based in Lagos Nigeria.

order generic cefdinir – buy cheap generic cleocin where can i buy clindamycin

permethrin price – buy benzoyl peroxide paypal order retin generic

order prednisone 10mg without prescription – cheap prednisolone tablets order permethrin online

metronidazole 400mg for sale – purchase metronidazole pills buy cenforce

cost betamethasone 20 gm – adapalene price buy monobenzone for sale

buy cleocin 300mg generic – cheap cleocin 150mg order indocin 75mg for sale

purchase augmentin generic – oral levothyroxine levothyroxine over the counter

order eurax generic – order eurax sale buy aczone online

cozaar ca – order keflex 250mg generic buy cephalexin 500mg without prescription

buy bupropion 150 mg pill – shuddha guggulu where to buy shuddha guggulu usa

order provigil 200mg pill – meloset 3 mg generic melatonin 3mg uk

order progesterone sale – progesterone 100mg over the counter buy fertomid generic

capecitabine 500mg generic – buy naproxen 250mg online buy generic danazol 100 mg

aygestin 5 mg ca – order yasmin pill yasmin usa

alendronate drug – brand tamoxifen 20mg provera 5mg tablet

buy dostinex 0.5mg pills – premarin 600 mg pills buy alesse generic

estrace pill – cost femara 2.5mg buy arimidex tablets

г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ« – 50mg/100mg – г‚·г‚ўгѓЄг‚№ йЈІгЃїж–№ г‚·г‚ўгѓЄг‚№йЂљиІ© 安全

гѓ—гѓ¬гѓ‰гѓ‹гѓі гЃ©гЃ“гЃ§иІ·гЃ€г‚‹ – г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓі еЂ¤ж®µ г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓігЃ®иіје…Ґ

eriacta our – apcalis appoint forzest chill

гѓ—гѓ¬гѓ‰гѓ‹гѓі и–¬е±ЂгЃ§иІ·гЃ€г‚‹ – гѓ—гѓ¬гѓ‰гѓ‹гѓі гЃЇйЂљиІ©гЃ§гЃ®иіј イソトレチノイン гЃ©гЃ“гЃ§иІ·гЃ€г‚‹

crixivan order online – buy indinavir without prescription order voltaren gel cheap

order provigil 200mg online cheap – cefadroxil 500mg usa combivir order

valif online claim – purchase secnidazole online sinemet 10mg brand

ivermectin usa – carbamazepine pill tegretol over the counter

promethazine oral – ciprofloxacin 500mg generic order generic lincomycin 500mg

buy deltasone 10mg pills – purchase captopril for sale capoten sale

order generic isotretinoin – buy linezolid pills buy zyvox 600mg generic

generic amoxicillin – order diovan 160mg generic combivent 100 mcg pill

purchase zithromax pill – order tinidazole 300mg generic buy nebivolol 20mg sale

where to buy omnacortil without a prescription – buy prometrium pills for sale order prometrium generic

neurontin order online – sporanox pills itraconazole 100mg over the counter

order furosemide 40mg online – buy nootropil 800mg generic betamethasone 20gm price

doxycycline online – vibra-tabs for sale online glipizide 5mg price

buy clavulanate pill – order duloxetine sale buy duloxetine 20mg generic

augmentin 375mg price – amoxiclav sale cheap cymbalta

order rybelsus 14mg generic – levitra 20mg ca cyproheptadine brand

buy tizanidine pill – order generic tizanidine 2mg purchase hydrochlorothiazide for sale

buy viagra pills – sildenafil otc tadalafil generic

purchasing cialis on the internet – cialis price walmart order sildenafil 50mg online cheap

buy cenforce paypal – chloroquine tablet order glucophage 1000mg online

purchase atorvastatin for sale – norvasc online buy order generic prinivil

buy prilosec 20mg pills – buy generic prilosec 10mg cheap atenolol

order depo-medrol pill – aristocort usa brand triamcinolone 10mg

buy clarinex 5mg sale – desloratadine medication brand dapoxetine 90mg

cytotec sale – order orlistat pill diltiazem oral

zovirax 800mg uk – order zovirax 400mg for sale buy crestor 20mg online cheap

order domperidone 10mg pill – order sumycin 250mg pills order flexeril 15mg without prescription

generic domperidone 10mg – buy cyclobenzaprine generic buy flexeril without prescription

inderal usa – buy plavix 150mg sale methotrexate 10mg pill

buy warfarin generic – warfarin 5mg cost hyzaar canada

nexium pills – purchase imitrex online cheap imitrex cost

levofloxacin generic – order levaquin pill how to get ranitidine without a prescription

buy generic mobic for sale – flomax 0.4mg price tamsulosin 0.4mg tablet

modafinil online buy modafinil tablet order provigil generic cost provigil 100mg buy modafinil generic order provigil online cheap modafinil 200mg generic

More articles like this would make the blogosphere richer.

This is the gentle of scribble literary works I rightly appreciate.

order azithromycin 250mg generic – zithromax canada flagyl online order

order semaglutide without prescription – periactin pills order cyproheptadine 4mg without prescription

Thank you for your post. I really enjoyed reading it, especially because it addressed my issue. http://www.kayswell.com It helped me a lot and I hope it will also help others.

order domperidone 10mg generic – buy sumycin 500mg generic cyclobenzaprine 15mg cheap

generic propranolol – methotrexate sale methotrexate 5mg drug

buy amoxicillin – ipratropium 100mcg drug combivent 100mcg cheap

zithromax pill – nebivolol 20mg canada bystolic medication

buy cheap generic augmentin – atbioinfo buy generic ampicillin online

buy generic esomeprazole for sale – https://anexamate.com/ buy esomeprazole medication

warfarin us – coumamide losartan 50mg price

buy mobic pill – https://moboxsin.com/ meloxicam for sale online

order deltasone 5mg without prescription – https://apreplson.com/ prednisone 10mg without prescription

pills erectile dysfunction – fastedtotake.com the best ed pill

amoxil without prescription – comba moxi buy generic amoxicillin

buy diflucan 200mg without prescription – buy fluconazole sale generic forcan

buy cheap generic cenforce – fast cenforce rs cenforce 100mg us

safest and most reliable pharmacy to buy cialis – what does cialis treat how long does cialis take to work 10mg

cialis vs flomax – cialis store in philippines cialis com free sample

real viagra for sale – viagra cialis pills viagra soft tabs cheap

I’ll certainly carry back to read more. clomid comprar

The detail in this piece is remarkable.

This is the big-hearted of criticism I positively appreciate. https://buyfastonl.com/isotretinoin.html

This is the gentle of literature I in fact appreciate. https://ursxdol.com/get-cialis-professional/

More content pieces like this would insinuate the web better. https://prohnrg.com/

I truly liked the way this was written.

I learned a lot from this.

This is the description of glad I get high on reading. https://aranitidine.com/fr/viagra-100mg-prix/

This is the kind of information I enjoy reading.

Such a valuable read.

This is the kind of writing I enjoy reading.

I really enjoyed the style this was written.

Such a helpful resource.

This is the kind of writing I enjoy reading.

Thanks for creating this. It’s brilliant work.

More blogs like this would make the web more useful.

Such a valuable resource.

I genuinely appreciated the way this was written.

Thanks for posting. It’s excellent.

I found new insight from this.

I couldn’t resist commenting. Adequately written! https://ondactone.com/product/domperidone/

More blogs like this would make the online space more useful.

This post is top-notch.

I truly appreciated the style this was explained.

Thanks for putting this up. It’s evidently done.

buy ondansetron pills for sale

Thanks recompense sharing. It’s first quality. http://web.symbol.rs/forum/member.php?action=profile&uid=1170910

buy xenical cheap – https://asacostat.com/ order xenical 120mg generic

More posts like this would add up to the online space more useful. http://web.symbol.rs/forum/member.php?action=profile&uid=1175034

You can conserve yourself and your family by being alert when buying pharmaceutical online. Some druggist’s websites function legally and offer convenience, solitariness, cost savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/kamagra.html kamagra

This is the make of delivery I find helpful. aranitidine.com

The sagacity in this ruined is exceptional.

Daher bieten wir schnelle und sichere Zahlungsoptionen an. Diese Partnerschaften ermöglichen es uns, dir eine vielfältige und ständig wachsende Spielauswahl zu bieten. Von Zeit zu Zeit bieten wir auch einen No Deposit Bonus an, der es dir ermöglicht, unser Casino ohne eigenes Risiko auszuprobieren. Zudem steht unser Kundensupport rund um die Uhr bereit, um dir bei Fragen oder Anliegen zu helfen.

Partneranbieter wie Evolution, Pragmatic Play, Hacksaw Gaming und Nolimit City sorgen für Fairness bei Drittanbieterspielen. Werden Sie Teil von Shuffle – der besten Krypto-Casino-Seite 2025 – für blitzschnelle Krypto-Zahlungen, Top-Bitcoin-Casinospiele, riesige Casino-Boni und das innovativste Online-Glücksspielerlebnis. Egal, ob Sie gelegentlich oder wettbewerbsorientiert spielen, wir ermutigen Sie, die Kontrolle zu behalten und verantwortungsbewusst zu spielen. Sobald das Geld auf Shuffle ist, können Sie ohne Wartezeit Transaktionen durchführen und sofort wetten, spielen und Geld senden.

References:

https://online-spielhallen.de/1go-casino-aktionscodes-ihr-schlussel-zu-exklusiven-vorteilen/

Künftig erhalten Sie auch Neuigkeiten und Updates rund um Ihre Stammfiliale oder Filialen in Ihrer Nähe, beispielsweise bei Umbauten, Revitalisierungen, neuen Automaten oder Spielen. Zusätzlich zu den österreichweiten Kampagnen können Sie sich künftig auch für regionale Promotions qualifizieren und so noch mehr Spielguhaben (in Form von Promotiontickets) erhalten. Sobald Sie sich für einen Bonus qualifiziert haben, erhalten Sie eine automatische SMS und/oder eMail, dass Sie sich für Spielguhaben (in Form von Promotiontickets) qualifiziert haben. Ich teste immer wieder neue Online Spielotheken und finde beste Automatenspiele für dich heraus. Hinzu kommt der Faktor Tradition und die Auswahl an sicheren Zahlungsmethoden, wie beispielsweise PayPal.

Diese Titel bieten seltene Multiplikatoren und lassen sich nahtlos in laufende Eventmechaniken integrieren, was sowohl Unterhaltung als auch ein höheres Gewinnpotenzial bietet. Für Spieler, die authentische Spannung erleben und gleichzeitig lokale Traditionen ehren möchten, bietet Admiral Casino eine neue Auswahl an Deutschland-inspirierten Spielen. Achten Sie auf neue wöchentliche Herausforderungen, die Ihnen Freispiele und sofortige € Boni bieten, die perfekt auf lokale Feiertage abgestimmt sind.

References:

https://online-spielhallen.de/ihre-umfassende-anleitung-zu-locowin-casino-bonus-codes/

Ohne anwaltliche Vertretung besteht die Gefahr, dass rechtliche Fehler gemacht werden, die nicht nur finanzielle Nachteile mit sich bringen, sondern auch langwierige Verfahren verursachen können. In unserem Rechtsblog behandeln wir aktuelle Themen und stellen Ihnen wertvolle Tipps kostenlos zur Verfügung. Wir von G&L unterstützen dich dabei, deine Rechte gegen illegale Betreiber durchzusetzen. Auch können die Prozesskosten mitunter hoch sein, so dass die Betroffenen die Unterstützung von Prozessfinanzierern benötigen oder mit dem Anwalt ein Erfolgshonorar vereinbaren. Auslandsverluste können hingegen nicht zurückgefordert werden.

Die Illegalität wurde von in hunderten Urteilen von deutschen Gerichten bestätigt. Weisen Sie dabei auf das illegale Glücksspiel hin und bitten Sie um Zurückbuchung des gezahlten Betrags („Chargeback“). Wir stellen Ihnen auf Anfrage gerne geeignete Vorlagen in deutscher und englischer Sprache für die Abfrage Ihrer Daten zur Verfügung.

Dazu zählen auch große bekannte Glücksspiel-Anbieter wie DrückGlück, Hyperino, Mr. Green, Platincasino und Wunderino. Bis zu diesem Zeitpunkt haben so gut wie alle Online-Casinos ihre Leistungen illegal angeboten. Neben Landgerichten sprechen auch zahlreiche Oberlandesgerichte Spielern eine Rückzahlung ihrer Spielverluste zu. Mittlerweile positionieren sich fast alle deutschen Gerichte verbraucherfreundlich und entscheiden zu Gunsten betroffener Spieler.

References:

https://online-spielhallen.de/vollstandige-analyse-der-vegadream-casino-erfahrungen/

Gain more visibility into your managed devices by monitoring critical aspects and receiving alerts as soon as your attention is required. Supercharge your help desk by providing proactive IT support instead of just reacting to service calls. Know more about your devices — manage, monitor, and protect them. With TeamViewer Remote, your devices, files, and applications are just a few clicks away, so you can stay productive wherever you are. Tech defects, system errors, and software queries result in costly downtime, but even if IT issues are unavoidable, slow response times are not. Use AI-powered capabilities to help your IT support teams work smarter and more efficiently.

Whether it’s providing remote connections, solving tech issues, or accessing customers’ mobile screens—TeamViewer offers all this and more. Start the session on the outgoing device to connect to and remotely control the incoming device. Reduce downtime, streamline IT support, and keep your teams productive—securely and efficiently. Connect directly to your loved one’s device and fix software and hardware issues remotely. Remotely assist friends and family with IT problems and access your personal devices from anywhere.

References:

https://blackcoin.co/casino-bonuses-in-australia/

Play live variants of roulette, blackjack, baccarat, and more. Choose from Fruit, Wolf, Book-style pokies, and countless others. You can explore demo versions even without an account.

The platform supports both traditional payment methods and modern cryptocurrency options, ensuring instant deposits and efficient withdrawals. KingBilly provides Australian players with comprehensive banking solutions that combine security, speed, and convenience. And holds a trusted Curacao license issued by Antillephone N.V., ensuring a safe and fair gaming environment.What sets King Billy apart is its remarkable collection of over 5,000 games from 50+ leading software providers, creating a truly royal gaming experience. With our extensive payment options, you can focus on enjoying your favorite games without worrying about the logistics of funding your account. But that’s not all – our robust VIP loyalty program rewards dedicated players with higher cashback, free spins, and exclusive perks. King Billy Casino is proud to present an exclusive VIP Program designed specifically for our most loyal players.

References:

https://blackcoin.co/online-gambling-in-australia-a-comprehensive-overview/

There’s no need to download heavy apps or worry about compatibility — the website behaves like a mobile app, accessible instantly from any browser. With more Aussies choosing to play on the go, Wolf Winner Casino AU has made mobile-first design a priority. Wolf Winner Mobile App brings the full casino experience directly to your pocket. This dedication to speed and reliability is one of the reasons so many players across Australia are joining our community.

These games add a fun twist to the gaming experience at Wolf Winner, giving players a chance to try something different while enjoying the thrill of potential wins. Aussie players can enjoy access to their favorite games anywhere, anytime, whether on a commute or relaxing at home. Wolf Winner is an online casino that offers a wide range of exciting games, including slots, table games, and live casino experiences.

References:

https://blackcoin.co/play-online-jackpot-jill-casino-australia-your-ultimate-guide/

How can I keep track of the bonuses I’ve used? Purchased bonuses appear in the Pending Bonuses tab, and redeemed bonuses are visible in the Bonuses section. Explore our virtual store for bonuses like Deposit Bonuses, Free Chips, and Free Spins. What are the exclusive bonuses mentioned? Please note that terms and conditions may apply and players have to be eligible to participate.

Enjoy a welcome package up to $4000, plus regular promotions and daily bonuses to maximize your playing potential and excitement. Our state-of-the-art platform brings the excitement of a real casino directly to your screen, offering a seamless and immersive gaming experience for players of all skill levels. Ozwin Casino offers an array of bonuses including a welcome package for your first deposit, no-deposit bonuses, cashback offers, and free spins.

Whether you’re exploring for the first time or chasing a high-stakes bonus round, the platform provides verified RTP and maxwin stats upfront for every game. The game selection at Ozwin Casino covers all play styles, from casual spins to high-volatility jackpots. Independent reviews consistently highlight Ozwin’s fast withdrawals, clear bonus terms, and transparency in processing policies.

References:

https://blackcoin.co/live-casinos-in-australia/

OpenAI says that ChatGPT Gov enables agencies to more easily manage their own security, privacy, and compliance, and could expedite internal authorization of OpenAI’s tools for the handling of non-public sensitive data. OpenAI says it collects user posts from the subreddit and asks its AI models to write replies, in a closed environment, that would change the Reddit user’s mind on a subject. OpenAI used the subreddit r/ChangeMyView to measure the persuasive abilities of its AI reasoning models. In response to pressure from rivals like DeepSeek, OpenAI is changing the way its o3-mini model communicates its step-by-step “thought” process.

OpenAI is expanding its affordable ChatGPT Go plan, priced under $5, to 16 new countries across Asia, including Afghanistan, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, Laos, Malaysia, Maldives, Thailand, Vietnam, and Pakistan. Unlike other AI browsers, Atlas is open to all users and will soon come to Windows, iOS, and Android, as OpenAI aims to make ChatGPT the go-to tool for browsing the web. The launch date and whether it will be standalone or integrated with ChatGPT and Sora remain unclear.

References:

https://blackcoin.co/winx96-casino-in-australia-real-money-gaming-fun/

Some games have a progressive jackpot that grows over time until a lucky player wins. Undoubtedly the number one most popular option, slot games are easy to play and come in all shapes and sizes. Free spins are granted to loyal players as part of ongoing promotions, events, or loyalty rewards. This is because you do not play for real money at these sites but for prizes. Favor casinos that hold valid gaming licenses from recognized authorities. A good online casino supports diverse casino payment methods suitable for global users.

Our emphasis isn’t just on technical security systems but also on transparent practices that respect player data. We analyze the security protocols of each casino to confirm that they take extensive measures to protect your data. It can be overwhelming to browse through the many sites to find the right one to use, and that’s why our experts have done the hard part. It is also much cheaper since you don’t have to drive all the way to your preferred casino or worry about gas and food expenses. As long as the casino is licensed, such as those recommended here, you can trust the payments to be reliable. Round-the-clock support should still be considered a major benchmark, because no player should wait long to receive help.

Top-rated gambling sites for real money offer good casino bonuses for both new and existing players. Crypto online casinos in the US make it possible to choose from a variety of cryptocurrencies that you can use to play real money games. Yes, many online casinos offer demo or free play modes for most of their games. The top 10 online casinos listed in this guide offer a combination of high-value bonuses, diverse game options, and secure transactions. We also look for online casinos that provide a diverse range of games, attractive welcome bonuses, and a solid overall reputation. Our list of online casinos for real money USA features platforms you can trust to deliver a top-notch gaming experience.

References:

https://blackcoin.co/playamo-casino-safe-online-casino-in-australia/

paypal casinos online that accept

References:

http://pasarinko.zeroweb.kr/bbs/board.php?bo_table=notice&wr_id=8368984

online american casinos that accept paypal

References:

https://sangrok.net/bbs/board.php?bo_table=free&wr_id=1283

online australian casino paypal

References:

https://activeaupair.info/employer/best-paypal-casinos-2025-best-casinos-accepting-paypal/

online casino that accepts paypal

References:

https://cchkuwait.com/employer/best-online-casinos-that-accept-paypal-in-canada/

online poker real money paypal

References:

https://www.jobindustrie.ma/companies/11-best-online-casinos-in-the-us-2025/

online casino usa paypal

References:

https://placifyconnect.com/employer/best-online-casinos-australia-2025-top-10-aussie-casino-sites/