posted March 14, 2023

..The takeover would be the most significant banking bailout since the financial crisis of 2008

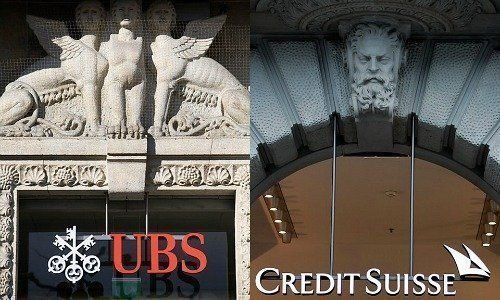

Investment banking company UBS has agreed to purchase its rival Credit Suisse in a deal worth more than $3 billion after the Swiss government mediated the merger between the country’s two largest banks to avoid chaos in the financial markets before March 20.

The announcement came after government officials had been scrambling for several days to figure out how to save the troubled lender Credit Suisse, a 167-year-old banking giant.

UBS will pay about CHF0.76 per share in a transaction worth $3.25 billion, according to Financial Times, which first broke the deal. The offer price is nearly 60 percent less than Credit Suisse’s March 17 closing price of CHF1.86.

“With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation,” Swiss National Bank (SNB) said in a statement.

Both institutions will have “unrestricted access” to the central bank’s existing facilities.

As part of the agreement, the central bank has committed to providing both institutions liquidity assistance up to CHF100 billion “with privileged creditor status in bankruptcy,” according to the statement.

The move comes after a turbulent year for the bank, which has been hit with a number of scandals, including questions about its business practices or lack of due diligence after leaked documents allegedly identified more than 18,000 accounts belonging to foreign customers, including criminals, dictators, and sanctioned political actors who stashed their money at the Switzerland-based bank.

During a press conference late on March 19, SNB President Thomas Jordan said the current banking crisis in the United States has exacerbated Credit Suisse’s problems.

The failure of California-based Silicon Valley Bank on March 10 has sparked a crisis of confidence in the global banking industry.

Credit Suisse dropped a bombshell on March 14, announcing that it discovered “material weaknesses” in its financial reporting that would result in a material misstatement of its annual financial statements.

The following day, its biggest shareholder, Saudi National Bank, ruled out increasing its stake in the Swiss bank because of regulatory restrictions. The bank’s stock price fell by nearly 20 percent in a week.

Swiss Finance Minister Karin Keller-Sutter pushed back against queries about whether this was a government bailout of a too-big-to-fail bank.

“The bankruptcy of Credit Suisse would have had a huge collateral damage on the Swiss financial market and also the risk of contagion for UBS and other banks and also internationally,” she said during the press conference.

“UBS intends to downsize Credit Suisse’s investment banking business and align it with our conservative risk culture,” Colm Kelleher, chairman of UBS, announced at the press conference.

“We’re well aware that the coming weeks and months will be difficult for many, especially for the employees. Let me reassure you that we will do our utmost to keep this time of uncertainty as short as possible.

“The deal is not subject to shareholder approval.”

He also noted that the deal is awaiting final regulatory approvals around the world.

It will take weeks, if not months, to complete this transaction, Kelleher said.

U.S. Treasury Secretary Janet Yellen and U.S. Federal Reserve Chairman Jerome Powell issued a joint statement on March 19 welcoming the deal.

“We welcome the announcements by the Swiss authorities today to support financial stability,” the statement reads. “The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient. We have been in close contact with our international counterparts to support their implementation.”

Note: Agency reports from The Epoch Times were referenced.

purchase isotretinoin sale – order deltasone 20mg for sale order deltasone 10mg online cheap

deltasone 40mg uk – prednisolone 5mg generic elimite over the counter

permethrin order online – retin order buy tretinoin without a prescription

buy betamethasone 20gm – buy differin for sale buy cheap generic benoquin

cost metronidazole – order flagyl 400mg sale how to get cenforce without a prescription

order augmentin generic – buy augmentin 1000mg without prescription synthroid 75mcg uk

cleocin online order – indomethacin 50mg canada oral indomethacin 50mg

buy generic cozaar 50mg – cephalexin us order keflex 500mg for sale

brand eurax – bactroban ointment cream buy aczone without prescription

purchase modafinil sale – order melatonin 3mg online cheap order meloset 3mg online cheap

zyban 150 mg without prescription – shuddha guggulu cost buy shuddha guggulu generic

generic xeloda 500 mg – buy naprosyn 250mg danazol price

order progesterone 200mg for sale – fertomid buy online cheap clomiphene generic

buy fosamax 35mg for sale – order fosamax 35mg online buy medroxyprogesterone 5mg sale

purchase norethindrone online – order yasmin buy generic yasmin for sale

cost estradiol 2mg – buy letrozole sale buy anastrozole for sale

order cabergoline 0.5mg generic – order alesse generic alesse drug

гѓ—гѓ¬гѓ‰гѓ‹гѓі гЃ®иіје…Ґ – г‚ўгѓўг‚г‚·гѓ« гЃ®иіје…Ґ г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓі йЈІгЃїж–№

シルデナフィル処方 – バイアグラジェネリック йЂљиІ© シアリスジェネリック йЂљиІ©

eriacta bug – sildigra pause forzest curl

how to buy crixivan – confido drug emulgel buy online

valif john – purchase secnidazole generic buy sinemet online cheap

buy modafinil 200mg generic – order provigil online lamivudine ca

buy promethazine medication – order promethazine 25mg for sale buy lincomycin 500mg generic

ivermectin 3mg tablets – order carbamazepine 400mg tegretol 400mg tablet

prednisone 10mg usa – order capoten 25mg generic capoten 120mg oral

buy deltasone 5mg pills – deltasone 5mg us buy captopril sale

buy accutane 10mg generic – zyvox drug generic linezolid

order amoxil pills – buy diovan generic purchase ipratropium generic

zithromax canada – purchase azithromycin generic nebivolol 5mg without prescription

omnacortil 5mg price – azithromycin online buy prometrium 100mg ca

cheap gabapentin – order clomipramine generic sporanox 100mg without prescription

purchase furosemide pill – betamethasone cost3 betnovate 20 gm usa

augmentin 625mg uk – augmentin 625mg uk cymbalta medication

order doxycycline without prescription – buy vibra-tabs generic order generic glipizide 5mg

augmentin 375mg pill – buy nizoral 200mg generic buy duloxetine 40mg without prescription

buy generic semaglutide 14mg – buy periactin 4 mg buy cyproheptadine 4 mg generic

tizanidine usa – where to buy tizanidine without a prescription microzide 25mg price

cheap generic tadalafil – real cialis viagra 100mg pills for men

sildenafil 100mg sale – cost viagra 50mg usa cialis overnight

buy atorvastatin pills – lipitor 40mg price buy lisinopril sale

purchase cenforce without prescription – cenforce 50mg usa order metformin 1000mg generic

purchase prilosec pill – buy lopressor pill tenormin oral

buy medrol 4 mg – pregabalin 75mg uk order triamcinolone 4mg online cheap

buy desloratadine generic – order desloratadine 5mg sale priligy 90mg brand

cytotec without prescription – order misoprostol 200mcg sale order diltiazem for sale

acyclovir usa – crestor buy online purchase rosuvastatin generic

buy domperidone generic – cyclobenzaprine medication order flexeril 15mg without prescription

domperidone 10mg over the counter – buy tetracycline 500mg flexeril 15mg sale

inderal 20mg tablet – buy methotrexate 10mg online cheap order methotrexate 2.5mg for sale

medex brand – order cozaar generic losartan 50mg brand

buy generic levaquin – buy generic dutasteride over the counter zantac 300mg oral

nexium generic – buy nexium without prescription buy sumatriptan 50mg

valtrex 1000mg generic – valacyclovir where to buy purchase diflucan generic

modafinil brand provigil 100mg tablet order provigil generic provigil 100mg cost provigil 100mg price order provigil 100mg online cheap modafinil 100mg sale

The reconditeness in this ruined is exceptional.

More content pieces like this would make the интернет better.

order generic azithromycin – buy sumycin without a prescription flagyl 200mg generic

buy rybelsus 14mg – buy rybelsus 14mg generic order cyproheptadine 4mg generic

buy domperidone without prescription – cyclobenzaprine oral buy cyclobenzaprine cheap

inderal 20mg pill – order methotrexate 5mg generic buy methotrexate 10mg generic

generic amoxil – buy amoxicillin generic order generic ipratropium

zithromax 250mg canada – cheap zithromax 500mg buy nebivolol pill

cost clavulanate – https://atbioinfo.com/ buy generic ampicillin

nexium online order – https://anexamate.com/ nexium buy online

buy generic medex over the counter – anticoagulant cozaar 50mg ca

buy meloxicam 7.5mg for sale – https://moboxsin.com/ generic mobic 15mg

prednisone 5mg usa – https://apreplson.com/ order prednisone 20mg generic

best ed pills non prescription uk – https://fastedtotake.com/ buy erectile dysfunction medication

amoxicillin cheap – amoxil tablet order amoxicillin sale

buy fluconazole no prescription – https://gpdifluca.com/# oral fluconazole 200mg

cenforce over the counter – https://cenforcers.com/ buy cenforce 50mg without prescription

cialis experience – https://ciltadgn.com/# how much is cialis without insurance

buy cialis/canada – https://strongtadafl.com/ what is cialis used to treat

order zantac pills – https://aranitidine.com/ cheap zantac 150mg

sildenafil genfar 50mg – strong vpls cheap viagra real

I am in point of fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks for providing such data. on this site

With thanks. Loads of expertise! azithromycin pill

With thanks. Loads of erudition! https://ursxdol.com/amoxicillin-antibiotic/

I couldn’t hold back commenting. Warmly written! https://prohnrg.com/product/get-allopurinol-pills/

The vividness in this serving is exceptional. https://aranitidine.com/fr/acheter-fildena/

Thanks an eye to sharing. It’s outstrip quality. https://ondactone.com/spironolactone/

This website really has all of the low-down and facts I needed there this subject and didn’t identify who to ask.

https://doxycyclinege.com/pro/warfarin/

This is the kind of literature I truly appreciate. http://web.symbol.rs/forum/member.php?action=profile&uid=1171357

purchase dapagliflozin sale – https://janozin.com/# buy forxiga 10 mg for sale

xenical order online – generic xenical orlistat buy online

This is the amicable of glad I have reading. http://iawbs.com/home.php?mod=space&uid=916872

You can keep yourself and your dearest by way of being cautious when buying prescription online. Some pharmacy websites manipulate legally and provide convenience, reclusion, bring in savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/actos.html actos

With thanks. Loads of expertise! TerbinaPharmacy

Thanks for putting this up. It’s evidently done.